capital gains tax news canada

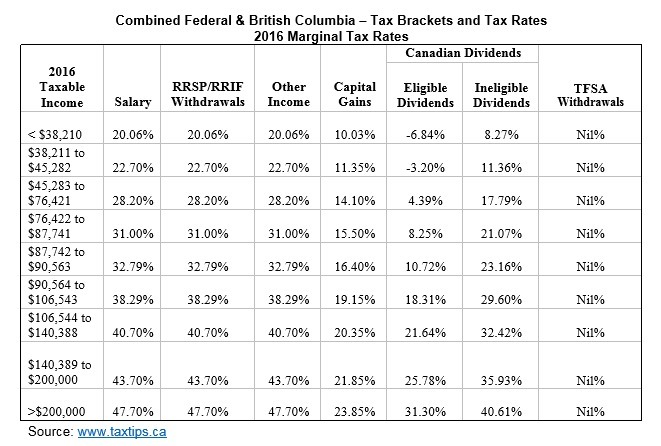

In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than.

![]()

What Is The Capital Gains Tax In Canada

Published January 12 2021 Updated February 9 2021.

. Is there a one-time capital gains exemption in Canada. The taxes in Canada are calculated based on two critical variables. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

The capital gains exemption is cumulative and. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. Sep 07 2016 A sole proprietor will pay capital gains tax on real estate sales in Canada of a rental property.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. In Canada capital gains tax is applied to 50 of the profit you made. Real estate capital gains tax should be non-starter - Toronto Sun and find out a lot of new information with us.

Net of the 5000 previously-claimed capital gains. This would bring her to a taxable income of 33500. Written By Helen Burnett-Nichols What are capital gains.

Canadians pay a 50 tax on all of their. As of 2022 it stands at 50. The 50 percent inclusion rate remained in place until the late 1980s.

How to prepare for a potential tax hike on capital gains. Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. Olivia is in the.

Special to The Globe and Mail. For example if a Canadian in the effective tax bracket of 33 bought a piece of real estate for 500000 and sold it for 600000 the taxable capital gain amount would be 50000 and as a. Ad If youre one of the millions of Americans who invested in stocks.

A 1031 tax deferred exchange which allows an. On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal. 3 PAYING A DEPARTURE TAX.

Olivias total capital gain is 7000. The inclusion rate is the percentage of your gains that are subject to tax. Buy Bitcoin with AMEX.

Different types of realized capital gains are taxed by the CRA including securities some forms of real estate and other personal property that tends to increase in value over time. A capital gain is any profit made from the sale of. The capital gain on the sale is reported on Schedule 3 and line 127 of your tax return.

On August 9 2022 the federal Department of Finance Finance Canada released a large package of draft legislation covering several tax measures from the 2022 federal. On June 18 1987 Finance Minister Michael Wilson announced that the rate would increase to 6623. In 2021 the net capital losses from 2018 can reduce the taxable capital gains to zero leaving 14000 of net capital losses.

Congratulations now that you have earned a profit on your investment report it on your tax return because it is a taxable capital gain. Long-term capital gains tax profit from the sale of asset or. Since the inclusion rate is 50 her taxable capital gain is 3500.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. If the heir owns the property for more than a year he or she will be taxed at 0 15 or 20 on the long-term capital gains. The inclusion rate has varied over time see graph below.

The moment a resident leaves Canada the CRA deems that they have disposed of certain kinds of property at fair market value and. On the flip side an. If your capital gains are 100000 you will be subject to a capital gains tax on 50000.

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Canadian Coin News Subscription Coin And Stamp Supplies

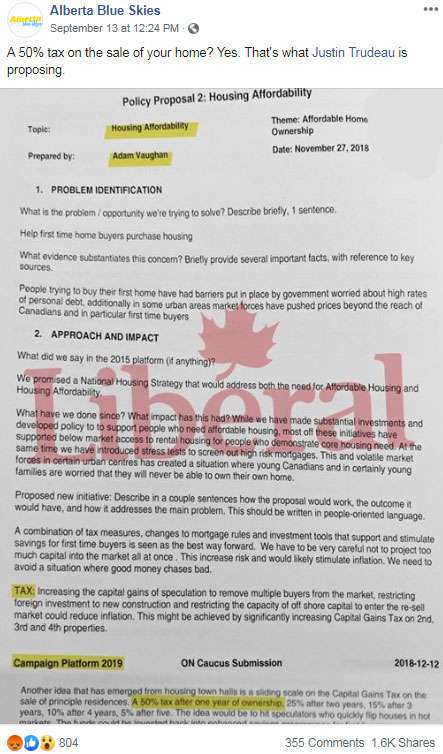

Fact Check Canada S Liberals Plan Capital Gains Tax On Home Sales

Here Are Tips If You Worry About Capital Gains Tax Hike Bnn Bloomberg

How Do Capital Gains Work National Bank

The States With The Highest Capital Gains Tax Rates The Motley Fool

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/7YDJFYY5XFCBHP2UCALOVAIIFY.jpg)

How To Prepare For A Potential Tax Hike On Capital Gains The Globe And Mail

Canadian Tax News And Covid 19 Updates Archive Cpa Canada

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Capital Gains 101 How To Calculate Transactions In Foreign Currency

2016 Federal Budget Commentary Pacific Spirit Vancouver Financial Advisors Wealth Management

Jonathan Garbutt Talks Capital Gains Taxes In Canada With Shiraz Ahmed On The Quarantine Broadcast Andersen

Why A Capital Gains Tax On Principal Residences Won T Help To Cool The Housing Market Globe And Mail Op Ed C D Howe Institute Canada Economy News Canadian Government Policy

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Political Suicide Capital Gains Tax On Home Sales A Risky Proposal Experts Say National Globalnews Ca

It S Time To Increase Taxes On Capital Gains Finances Of The Nation